Trade and Economic Cooperation Between China and CEE countries(second parte)

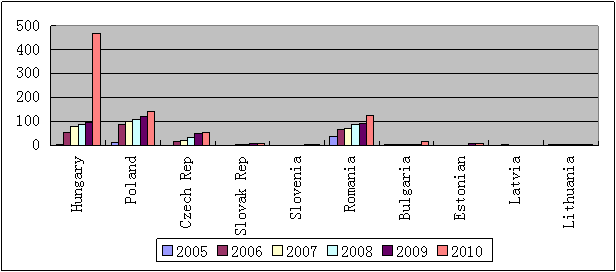

On capital stock, Hungary, Poland and Romania are the big three destination for Chinese investment (Graphic 10).

Graphic 10 China's outward FDI stock into CEE countries 2005-2010, millions of USD

Note: Data for 2005, 2006 include only non-financial outward FDI stock.

Million USD. Resource: 2010 Statistical Bulletin of China's Outward Foreign Direct Investment.

The growth model of the China's trade

China actively integrated itself into the international market and world economy after joining the WTO, and at the same time promoted the arrangement of the labor division and capital flows in East Asia.

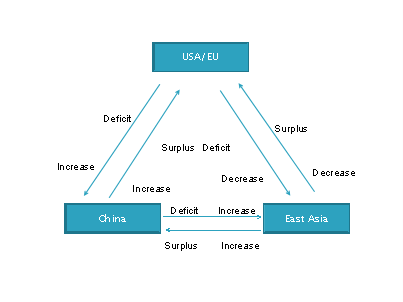

Because of China's incomparable advantage of labor cost and favorable conditions for absorbing foreign investment, huge processing trade had flowed to China accompany with the capital flows from the countries and regions in East Asian economies like Japan, South Korea, Taiwan etc. China's export started an explosive expansion to the world markets. The trade surplus with EU (and also USD) is growing, and the trade deficit with East Asian economies is increasing either at the same time.

On the other hand, because the mass production had been moved to China, these East Asian economies' trade surplus with EU/USA is dramatically declined. In other words, these trading partners exported directly to EU/USA with huge surplus before China's entry into WTO. Now they export semi products and parts to China, assembled and manufactured, then export to EU/USA as China's export. The trading pattern dramatically changed and the economic integration deepened in East Asia. A trade triangle has been emerged among China, EU/USA and the other main economies in East Asia (Graphic 11).

Graphic 11 Trade Surplus - A Triangle

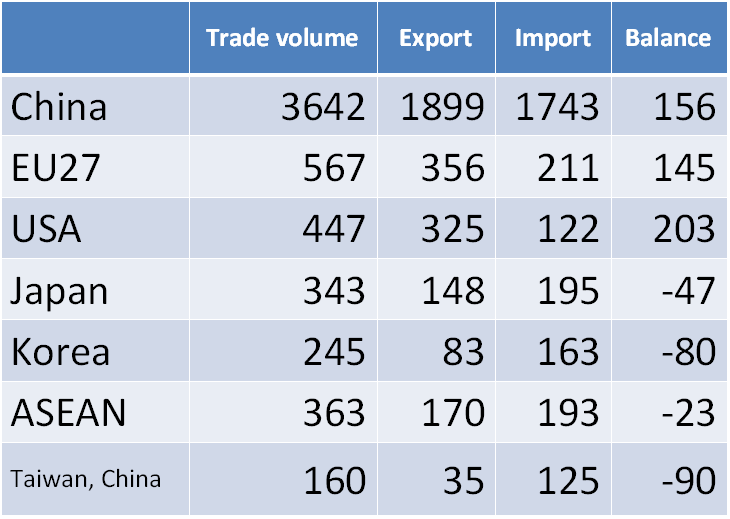

Table 5 shows the data on China's main trading partners in 2011. As we see, China has a trade surplus with EU and USA, but at the same time China has trade deficit with Japan, Korea, China Taiwan and ASEAN economies.

Table 5 The main trading partners of China in 2011

In billion USD. Resource: China Customs.

The relevant statistics supported this triangle model. China's export to EU increased from 23.8 billion USD to 245.2 billion USD between 1997 and 2007, 10 times growth in 10 years, and Asia's share of total EU imports has increased only very moderately by 10% over the last decade[1]. China became the world factory and assembly line, and replaced the other East Asian main economies export to EU.

The investments from EU and USA accelerates the trade surplus, as parts of the investments from EU and USA, especially the Multi-National Cooperation dominated investments, contributes to the processing trade.

With the bilateral trade figures, it cannot be observed and concluded that what the value-added part it is in the China's export to EU. As well known, China's processing trade mainly locates at the end of the production chain, and the Chinese enterprises gain the little processing fees. When the product is exported, it is calculated on the price of the whole product, not the price which the value-added work produced. Therefore, in the price of the product export to EU after the processing manufacturing and assembling in China with the parts and semi products imported from other economies including from EU, the price of the imported parts and semi products is also included. China has the name of the trade surplus, but bears all the imported prices from other economies with processing trade. It is not hard to understand that why China has huge trade deficit with Japan, South Korea. Besides, the foreign enterprises take nearly 60% of the China export to EU, including the EU enterprises in China. In the biggest category of the China's export to EU, the machineries and electronics, Chinese enterprises can only gain the 10% of the sales, the other 90% sales are realized by the foreign enterprises in China. In the textile category, the profit of the Chinese enterprises is less than 5%.

With the bilateral trade figures, it cannot be observed and concluded that in what extent the European enterprises enjoy the huge opportunities in Chinese market through their investment in China. East Asian economies' investment in China is mainly vertical, and the investment transfers the trade. European investment in China is mainly horizon, and the investment replaces the trade. On the one hand, the spill-over impact of the foreign enterprises in China improved the competitiveness of Chinese products, and promoted China's export to EU. On the other hand, As EU investment in China is growing, their local products are sold in China, which replaced the EU export to China and sharpened the China-EU trade unbalance[2]. Some Chinese scholars used the panel data to make an empirical research on the relationship between China-EU trade and EU investment in China. The results showed that EU direct investment in China is one of the reasons of the growing China-EU trade surplus[3].

With the bilateral trade figures, it cannot be observed and concluded that in what extent the cheap and competitive Chinese products had made savings for the European consumers. When the former trade commissioner Peter Mandelson delivered a speech at Tsinghua University, he referred to one study from the Netherlands which suggested that cheaper Chinese goods have saved the average European household around 300 Euro a year[4]. Also according to the OECD statistics, China's export to Europe made the inflation rate 0.2% lower in the Eurozone, which leaded 60 billion USD savings a year for the EU consumers[5].

In general, China-EU trade surplus in some extent goes beyond the bilateral scope. On the one hand, what EU faces is not a simple challenge from China, but from the fact of Asia's increasing economic integration. China may be a central pillar of this integration, but it is one part of a much broader phenomenon[6]. EU always treats itself as the model of regional economic integration, it should be well aware of the challenge. On the other hand, "China does behave in the way economic theory as well as Western politicians always have recommended"[7], and fast integrated into world economy. When the western countries suddenly find that they are facing China's export with a explosive growth, and the wealth flow changes from hundreds of years of sole direction in favor of the developed countries, to the two-way directions, they (including EU) are realizing that they do not be well prepared indeed[8].

China's approach in investment

Why to invest

When a Chinese company makes a decision on investment abroad, usually they have the following rationales. The first one is for the access to resources. Along with the rapid development of Chinese external trade, China becomes the World factory. Huge manufacturing capacity requires the substantial consumption on energy and raw material. The second one is the access to technology and distribution networks. More than 50% of Chinese export is based on the processing trade, which is part of the world production chain. China is in the lower end of the technology ladder and has started the climbing-up process. Access to technology and distribution network plays a significant role for Chinese companies in this regard. The last but not least one is close to the end market. Making investment is the best way for have a close sensor to the end market.

How to invest

The methods for Chinese investment are the Merge and Acquisition, Green Field investment, and for some extent leasing is also a widely used one. M & A takes an important share in Chinese investment, as M & A is the appropriate way for Chinese companies to access to the technology and distribution network, and also provides a short path to close to the end market. Leasing is also another useful tool for Chinese companies, especially for home electronics producers. They rent a workshop and imports parts and accessories from China, assemble them, and then sale the final product in the region. It is the exact way the processing trade has. Chinese companies are familiar with it. The advantage is that when crisis comes or the sales of the product is not satisfied, Chinese companies can easily close the workshop and keep the loss in the minimum level. In 2008-2009, we can see several Chinese cases in CEE region, like Hisense, Changhong and Lenovo.

What activities the Chinese investment in favour

Trade is the popular sector Chinese investment is in favour. They not only set up local sales companies, but also establish regional distribution centres. We can see the examples in Hungary, Poland and Romania.

Manufacturing is another widely applicable activities, especially in the field of producing electronics, IT and vehicle.

Mining is one of the major investment activities, but it is mainly in Latin America and Africa. It is not applicable for CEE.

Service is an emerging activity for Chinese investment, especially the financial service. Chinese banks register as the local banks and provide financial services to the local Chinese companies and partners. Bank of China had opened their first branch in CEE at Budapest for 10 years, and will soon open branches in other CEE countries. ICBC also has an expansionary business plan in the region.

Opportunities and obstacles for China to invest in CEE

When the Chinese companies make decision to invest in CEE region, they use to take the following advantages into their consideration, such as the established infrastructure, trained labor force with low cost, experience in manufacturing, EU membership. And last but not least the local need toward FDI for economic growth, which means the welcome to the FDI.

The CEE region is also an New Land for Chinese investment. The business possibilities are under estimated by the Chinese companies. With the investment in CEE region, Chinese companies can have a better access to EU internal market. They can upgrade their technology by investment, and also contribute to Chinese domestic demand. China's traditional relationship with CEE can make Chinese investors more comfortable when decisions are taken. And Chinese investment to CEE is also a useful way for China to diversify its currency reserve. Last but not least, China's investment in CEE can provide contributions to improve the trade imbalance between China and EU, as well as China and CEE.

Although there are advantages and opportunities for China to invest in CEE, there are still some risks need to be mentioned.

The first one would be the language barrier. There are different languages in the region, which are not familiar for the Chinese investors. To overcome this obstacle means more cost to hire staffs with local language skills. The second one is connected with the first one, the lack of knowledge on the local market and investment environment. The third one is the consequences of the first twos, lack of professional service. And last but not least, the consistency of policy is also a key factor for investors to make a decision.

Some recommendations

For governments

For governments, their task is not only to absorb more and more investment, but also to working out a coordinated strategy in CEE region. Obviously China cannot have repeated investment in the region for same sector and same business, so the coordination among the countries is very important. The situation in the region is complicated. There are EU member states and Non EU member states, there are Eurozone countries and Non Eurozone countries. Even the population is differ. The coordination is difficult but very important.

Consistent policy is another key issue, as these countries have democratic system, which means the government may change based on the results of election. Despite of government changes, consistent policy would enhance the investors confidence.

Investment promotion agencies play key role. Their tasks are not only related to provide attractive investment environment, but also to support business training program, establish SME platform and improve country image in China.

Visa facilitation is also an important issue for Chinese investor. Now days a Chinese Taiwan farmer can entry into EU with visa free, but an potential Chinese investor from mainland need to face the complicated visa application procedure. Such kind of administrative obstacle may have an impact for Chinese investors to loose interest.

For investors

Maybe two advices are very important for Chinese investors. One is to get better prepared, and the other is that professional service is needed.

For social actors

In order to overcome the obstacles, language training should be promoted, not only by government but also social actors. And at the other hand, positive reporting on China's investment by mess media would encourage Chinese investors' decision.

[1] European Commission, “EU-China trade in facts and figures”, MEMO/09/40, Brussels, 30 January 2009.

[2] Feng Lei, Wang Yingxin, “Zhong Guo Dui Ou Meng Mao Yi Shun Cha Yan Jiu” ( A Study on the China’s Trade Surplus to EU), http://ies.cass.cn/Article/xshd/xshddsj/200710/539.asp

[3] Ye Wenjia, Yu Jinping, “Ou Meng Dui Zhong Guo FDI Yu Zhong Ou Mao Yi Guan Xi de Shi Zheng Fen Xi” (Empirical Study on the Relations between EU FDI to China and China-EU Trade), Shi Jie Jing Ji Yu Zheng Zhi Lun Tan, no.4, 2008, p27.

[4] Charles Grant, Katinka Barysch, Can Europe and China shape a new world order?, Center for European Reform (CER), London, May 2008, p.32.

[5] Speech delivered by Li Ruiyu, the Director General of the European DG, China MFA at a China-EU roundtable. http://www.chinamission.be/chn/sgxx/t520462.htm.

[6] Marcin Zaborowski edit, Facing China’s rise: Guidelines for an EU Strategy, Chaillot Paper No.94, EU Institute for Security Studies (EUISS), Paris, December 2006, p.18.

[7] Andreas Freytag, The Chinese “juggernaut” – should Europe really worry about its trade deficit with China?, Policy Briefs, No.2, European Centre for International Political Economy (ECIPE), Brussels, 2008, p.10.

[8] Inotai András, Az Európai Union és Kina Kapcsolatai: Múlt, Jelen és Jövő. In: Inotai András és Juhász Ottó eds., Kina: Realitás és Esély – Tanulmányok Magyarország Kina stratégiájának megalapozásához. Institute of World Economics, Hungarian Academy of Sciences together with Primer’s Office of Hungary, Budapest, 2008. p.101.