Forecast for 2015-2016

(Summary for the press-10 December 2015)

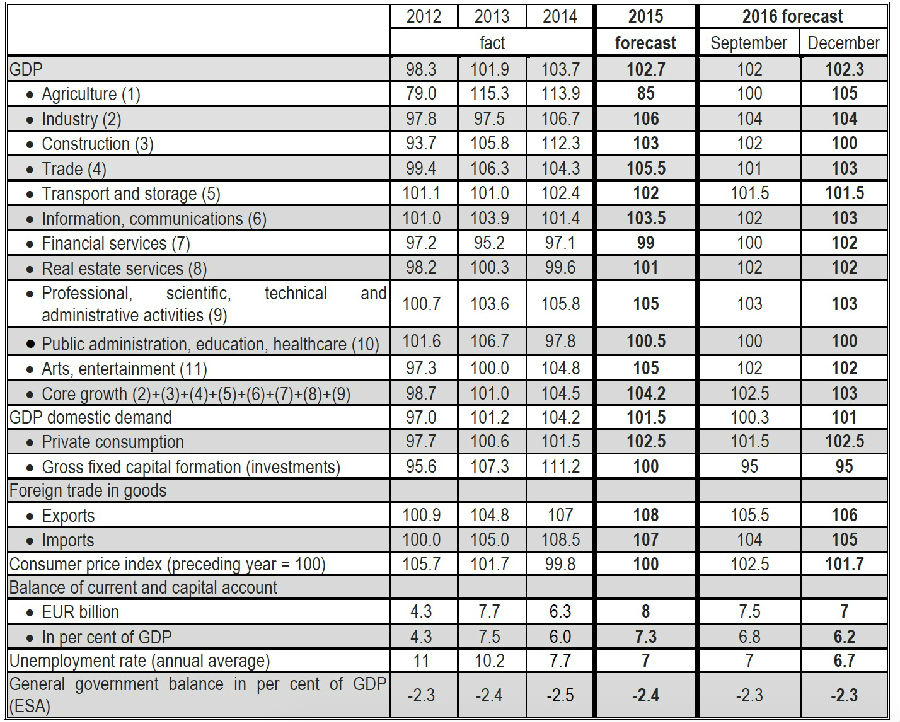

In accordance with the forecast of GKI, following a temporary rapid GDP growth in 2014, the dynamics of the Hungarian economy set to decelerate in 2015. GDP grew by 3.5 per cent in the first quarter of 2015, by 2.7 per cent in the second one and by 2.4 per cent in the third one. In the next quarters GDP is likely to increase only by about 2 per cent. GKI forecasts Hungary’s GDP to grow by 2.7 per cent in 2015 and by about 2.3 per cent in 2016. Following its stagnation in 2015, investments will drop next year (by 5 per cent). However, consumption will expand at a rate close to that of GDP, slightly lagging behind it in 2015, and slightly exceeding it in 2016 (around 2.5 per cent). Export surplus increased spectacularly in 2015. It will rise more slowly in 2016. External and internal equilibria are likely to develop favourably both in 2015 and 2016. Nevertheless, due to, among others, the unpredictability of economic policy, Hungary’s upgrading by international credit rating agencies is still some time ahead. The extra room of manoeuvring of banks resulting from the reduction of bank tax is diminished by the more active intervention of the National Bank of Hungary. No turnaround can be expected in the outflow of capital or labour due to the lack of perspectives. The deterioration of public services will continue.

According to international forecasts the growth of the world economy will slightly accelerate in 2016 compared to 2015. However, it will be lower than previously predicted, and GKI is unsure that it will accelerate at all. Germany’s role as a growth engine is weakening. Global economic growth will be negatively affected by the rise of the Fed’s benchmark interest rate (the strengthening of the dollar, and further GDP slowdown, together with a possible debt crisis of the indebted developing countries). The refugee crisis is causing conflicts among EU member states, and in the absence of substantive decisions and practices it may hinder the development of the EU. In spite of this, economic expectations are relatively optimistic in the EU and Hungary.

In recent months the present Hungarian government continued the completion of the “Hungarian model” bypassing market economy and the system of power-sharing institutions in order to restructure incomes in favour of their own social and business beneficiaries. Anti-EU attitudes reached a new, more manifest phase. Disagreements with the United States became again quite spectacular. Similarly to previous years, external and internal equilibria are likely to develop favourably in 2016 as well. Nevertheless, due to the insufficient credibility of the economic policy, Hungary’s upgrading by international credit rating agencies has not materialized yet. As a result, an at least partial compromise between the government and the banks is expected to get a new momentum, with the stronger intervention of the National Bank of Hungary focusing on concrete targets. However, the unpredictable investment environment marred by suspected corruption and the lack of perspectives deter both capital and labour. This restricts the effectiveness of the efforts of the government aiming at the acceleration of economic growth.

Between 2010 and 2014, Hungary’s GDP grew by an annual average of 1.3 per cent, less than the average of countries in the CEE region. By contrast, annual average net EU transfers reached 4.4 per cent of GNI, the highest level in the CEE region (together with Lithuania). The same rate was around 2 per cent in Slovakia and Romania, and 3-4 per cent in Poland, Bulgaria, Latvia and Estonia. According to some calculations, if EU transfers had been only 2 per cent of the national income in Hungary, Hungarian GDP would have stagnated or would have risen only marginally (by 0.2 per cent per year). Predominantly the extremely high inflow of EU transfers made the acceleration of growth in Hungary between 2013 and 2015 possible, similarly to the rise in foreign exchange reserves, the elimination of foreign currency loans and even the possibility of decreasing interest rates to such extent. The government slogan of “Hungarian reforms have worked” is quite misleading: the success was due to the inflow of more than 30 billion euros. In addition, the main obstacles to economic growth in Hungary until 2020 are not financial reasons or macroeconomic disequilibria but mainly the lack of trust and predictability. Another point is that in spite of the extremely favourable macroeconomic conditions, the microeconomic efficiency of the utilization of the transfers is horribly low, largely due to the incredible level of corruption.

In 2015 real earnings are expected to increase faster than last year (by 4 per cent) due to the accelerating wage growth and the very low rate of inflation. Real income will rise by 2.8 per cent. As a result of the rise in real incomes that has been under way for three years and the fall of credit burdens due to the settlement of FX loans by banks, consumption is predicted to go up by about 2.5 per cent in 2015 from 1.5 per cent in 2014. However, consumption of households will still be about 5-6 percentage points below the pre-crisis level, standing at its level of a decade ago. In 2016 the rate of increase of gross wages is predicted to accelerate to 4.5-5 per cent and the rate of inflation to about 1.7 per cent. The 1 percentage point reduction of the personal income tax rate will partly counterweight the rise of the inflation rate. Therefore, real earnings are expected to be up by 4 per cent again. After three years of increase, the real value of pensions will not change. Consumption will increase by 2.5 per cent, similarly to real incomes, due to the easing financial burdens of households and the slow reallocation of savings.

Following their fast increase in 2013 and 2014 (by a yearly average of 8 per cent), investments will stagnate in 2015 and fall by about 5 per cent in 2016. The main reason is the termination of projects funded by EU transfers as well as that of investments in the automotive industry. The willingness to invest is low and the overwhelming part of undertakings does not want to borrow. The investment rate was 21.7 per cent in 2014, and it is expected to drop to 21.1 per cent in 2015 and to 19.6 per cent in 2016, which is a very low level. Although investments will decline in several countries of the CEE region in 2016 due to the fading away of EU transfers, the decline is the largest by far in Hungary, whereas the growth in Poland and Romania will reach around 4-5 per cent, thanks to the performance of the business sector.

Since its 3.7 per cent growth in 2014, the Hungarian economy has been on a slowing trajectory. It is no surprise as the rapid GDP growth in 2014 was basically due to temporary factors, such as the peak of the inflow of EU transfers, the revitalization of consumption in connection with the election year, the excellent agricultural harvest and former automotive investments. No favourable turn of events can be expected in 2016. In addition to the fall in EU transfers, the propensity to invest of the business sector remains weak. Although the growth of consumption will be relatively fast, it will not accelerate. The rate of export growth will continue to decline. In case of average weather, the growth of agricultural production will not be prominent. Industrial growth will slow down considerably, the construction industry will stagnate, and retail sales will decline in statistical terms (the whitening effects will already be included in the statistical base). GDP growth is expected to be 2.7 per cent in 2015 and 2.3 per cent in 2016. This also means that GKI raised its 2016 annual growth forecast by 0.3 percentage points compared to its September forecast, especially due to the effects of the poor agricultural output in 2015 on the statistical base and the expected slightly positive impacts of bank tax reductions.

The number of employees is expected to grow by around 2.5 per cent in 2015 in all sectors of the national economy. This can be attributed to three reasons: declining but favourable dynamics of the business cycle, the dynamic expansion of employment abroad and a further increase of employment in public workfare schemes. Employment will be up by only 1 per cent in 2016. The statistical rate of unemployment is expected to decline to 7 per cent in 2015 and then drop to around 6.7 per cent in 2016. The real rate is somewhere around 9-10 per cent. Public workfare schemes are now an obstacle rather than a facilitator in the creation of real jobs. The shortage of highly qualified labour is increasing.

Both corporate and retail loans are expected to decline further in 2015. The corporate loan portfolio may start to increase modestly in 2016. As far as retail loans are concerned, only housing loans are likely to expand. The measures taken by the central bank to boost corporate lending are primarily symptomatic, as they do not address the real reasons arising from the Hungarian model. The period of interest rate increases that can be expected sooner or later will involve risks.

GKI believes that the realization of the planned general government deficit of 2.4 per cent of GDP in 2015 is very likely. The most important risks include the budget expenditures planned to substitute for possibly missing EU investment sources. However, the attainment of the deficit target of 2 per cent in 2016 relative to GDP is uncertain. The macroeconomic scenario underlying the budget adopted in early summer is too optimistic. In addition, there will be some losses in the planned tax revenues and the increasing of certain expenditure items seems to be necessary. Since 2009 Hungary’s combined current and capital account has been recorded increasing surpluses year by year. However, it is expected to decline in 2016 (from EUR8bn to EUR7bn) due to the fall in EU transfers. As a result of foreign direct investment inflow and outflow, Hungary’s FDI stock has not changed since 2009 (it reflected only the forced recapitalization of the banking sector). This can be considered a hard critic of the domestic investment environment.

The price level will stagnate in 2015, and the inflation rate is expected to be 1.7 per cent in 2016. The National Bank of Hungary is apparently intensifying its control over the banking system, thereby largely neutralizing the positive effects of the bank tax reductions. Thus there is not much hope to increase the loan portfolio. GKI forecasts that the base rate, in accordance with the objective of the National Bank of Hungary, will remain unchanged until the end of 2016, and the annual average exchange rate of the forint to the EUR will be HUF310 in 2015 and around HUF320 in 2016.

The forecast of GKI for 2015-2016