China-V4 economic cooperation: state of play and prospects”(second parte)

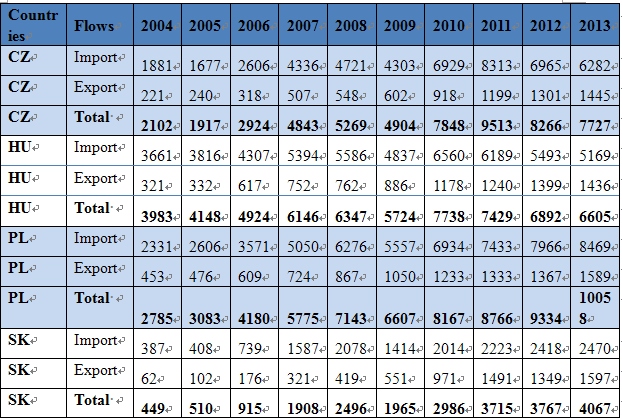

Table 1: V4 Trade with China 2004-2013 (in € million)

Source: Eurostat

Before V4 joined EU, the biggest China’s trading partner was Hungary. Currently, the first place is occupied by Poland. Poland is also the biggest China’s export market in CEE. Polish exports to the PRC consists of non-processed products such as copper, chemicals, lead ores and its concentrates, rubber, tubes, pipes, furniture and frozen pork. Poland also sells to China high-processed products - agriculture aircrafts, computer parts, machinery and vehicles. The share of highly processed goods in Polish exports to China increased recently from 23,4% to 29%. Additionally, one can observe increase of exports of agriculture goods and food to China, a result of opening Chinese market to Polish pork[1]. China’s exports to Poland include mainly engineering industry products and textiles. More than 53% of imports from China consist of high-processed goods which are used in Chinese, Korean and Japanese plants located in Poland (the so-called supply import). Main part of Polish imports from China consist of telephone and television sets’ parts, computers and computers parts, mobile phones, storage devices, modems, toys, converters, printing machinery parts, circuit boards, taps, cocks, valves, etc. [2]

Czech Republic is China’s second biggest trading partner and export market. Czech sells to China steam turbines, passenger cars and automobile parts, engines, generators and their parts, electrical devices, textile machinery, steel pipes and profiles, transmission shafts, machine tools, pumps, rubber and plastics processing machinery, glass, organic chemicals, dyes and pigments, plastics, ferrous and non-ferrous metal scraps. An important part of Czech export to China are Skoda parts for its plant near Shanghai – one of the biggest Czech investment in China. Looking at Czech import from the PRC, it consists of automated data processing equipment and components, telecommunications devices, TV and radio accessories, integrated circuits, electrical appliances, electronic devices, converters, organic and inorganic chemicals, clothing, footwear, fancy goods, toys and sports goods, bicycles, canned fruits and vegetables[3].

The third China’s biggest trading partner and export market and second source of import from Central Europe is Hungary. Hungary imports from China mainly electrical products and telecommunication equipment, machinery, mobile phones, plastic goods, medical optical instruments, organic chemicals, steel products, toys, furniture, garment products and footwear. Hungarian export consists of: machinery and electrical machinery products, e.g. spark ignition, parts of railway, transmission shafts and cranks, instruments, automatic processing machines, car components. Most of Hungarian export to China are send to the PRC by multinational companies based in Hungary.[4]

Slovakia is ranked as the fourth China’s biggest trading partner among V4 but the biggest source of import from CEE countries. Slovakian exports to China consists mainly of cars and auto parts but also electrical machinery, footwear, furniture, rubber and paper products. In case of Slovakia, its rather high export to China is generated mainly by sales of cars (in 2010 cars sales represented 79% of total Slovak export to China[5]), mainly Audi Q7 and Volkswagen Touareg, produced in Volkswagen Group's plant in Bratislava. China exports to Slovakia mainly high technology equipment such as optical instruments, telecommunication and electronic equipment and textile products[6]. Slovak negative trade balance with China is the lowest among V4 countries.

Mutual Investments

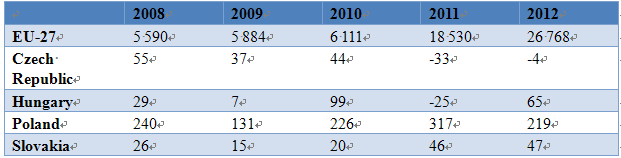

In 2012, the stock of Chinese investments[7] in Visegrad countries totaled of about €327 million. Main beneficiaries of Chinese investments are: Poland (€219 million), Hungary (€65 million) and Slovakia (€65 million). However, Czech Republic recorded a negative investment stock of about €4 million. In 2012 China’s stock of investments in EU27 was about €27 billion, which means that China’s investments in V4 countries represent only 1.2% of Chinese FDI in EU27 (table 2) .

Table 2: Direct investment stocks from China, 2012 (in € million)

Source: Eurostat

Chine is the leading recipients of foreign direct investment, but the presence of companies from V4 countries in China is marginal. At the end of 2012 V4 countries’ FDI stock in China stood at the was about €191 million. According to the Eurostat data, the biggest investor in China is Poland (€132 million), then Hungary (€31 million) and Czech Republic (€28 million). There is no registered Slovakian FDI in China. Bearing in mind that EU27 FDI stock in China at the end of 2012 was about of €118 billion, V4 investments in the PRC represents only 0,16% of all EU27 FDI in China[8].

According to Chinese data, the biggest Chinese investments in V4 countries are located in Hungary, then in Poland and Czech Republic. In 2010 five countries from CEE (Hungary, Poland, Czech Republic, Bulgaria and Romania) absorbed all Chinese FDI in CEE region. Share of Hungary in Chinese FDI in Central Europe was about 89%[9].

There are about 5000 Chinese companies in Hungary. Most of them belong to SME sector (mainly clothing and shoes shops and restaurants) and were established in early 1990s by Chinese immigrants which came to Hungary after introducing visa abolishment policy (1988-1992)[10]. The biggest Chinese investments in Hungary are chemical giant Wanhua which, investing in 2011 about €1.5 billion, acquired full control over Hungarian isocyjanate producer Borsod Chem. Currently, this company is the biggest TDI and MDI producer in Europe[11]. Chinese investors in Hungary are also IT companies – Huawei and ZTE. Budapest is Huawei European headquarters, in Pecs and Komarom are Huawei’s Europe Supply Centers (assembly plants) that serve Europe with Huawei’s products from Hungary (products are sold mainly to Italy and Germany)[12], there are also two logistic centers inBiatorbágy and Üllő .

Hungary is the first V4 and CEE country where Bank of China (BoC) opened its branch (in 2003). The second BoC office was set up in Hungary last year. Furthermore, in 2010, the China Investment Promotion Agency (CIPA) of the Ministry of Commerce opened its European office in Budapest. Hungarian side argues that main reasons for this step are country’s location in the center of Europe, professional labour force, direct flights between China and Hungary[13] and the only in Central and Eastern Europe branch of Bank of China. It is also worth mentioning, that Hungarian Commissioner for China-Hungary relations, during his stay in the PRC, April this year, signed an agreement about strategic partnership between Hungarian government and Huawei Technology and negotiated with China Exim Bank project of Budapest-Belgrade railway development. Recently, the Hungarian Investment and Trade Agency (HITA) signed a partnership agreement with the Hungarian-Chinese Chamber of Commerce in order to promote economic relations between two sides.

Hungarian investment in China mainly involves in the sectors of waterfowls breeding, and sewage water treatment, real estate, production of building materials. There is Hungarian investor Organica company (a joint-venture with Chinese company) in Shenzhen dealing with wastewater treatment. Other investors are GEA EGI Group – a Hungarian contracting and engineering company with projects (e.g. plant construction) in China, and EUBAU with its factory in China manufacturing activated carbon from vegetable raw materials[14].

Poland is the second biggest investment destination for Chinese FDI in CEE region. The latest biggest Chinese investments in Poland are LiuGong which in 2012 purchased civilian part of steel mill in Stalowa Wola (the first full privatization in Poland by Chinese capital) and Tri-Ring Group which in 2013 invested (PLN 300 million) in the FŁT Rolling Bearing Factory in Kraśnik. Other Chinese FDI in Poland represent IT sector: TCL in Zyrardow and Digital View in Koszalin both manufacturing LCD panels; Nuchtech company in Kobylka, near Warsaw which produces X-ray inspection system used mainly in transport (e.g. in trains) and ZTE and Huawei Warsaw offices. Moreover, in Wola Kosowska near Warsaw is located a big Chinese and Asian products distribution center – GD Poland. Recently one can observe Chinese bank sector interest in Poland. Last year two biggest Chinese banks – Bank of China (BoC) and Industrial and Commercial Bank of China (ICBC) opened their branches in Warsaw.

The structure of these investments indicate that Polish entrepreneurs are interested mainly in mining (KGHM Shanghai Copper Trading – the first KGHM branch in Asia), pharmaceutical (Bioton), construction chemicals (Selena’s investments in Nantong zone where PU foams are produced and in Foshan with silicon plant) and clothing sectors (LPP clothing company is considering opening its own shops in China). It is also worth mentioning about Polish-Chinese joint-venture (the first joint-venture in the PRC’s history) Shipping Company – Chipolbrok – founded in 1951 with its offices in Shanghai and Gdynia.

Main Chinese investor in Czech is Changhong company – a TV manufacturer, which opened its plant the Industrial Zone of Nymburk city. The company invested $10 million and produces in Czech flat-panel and high-definiton TV sets. Other Chinese investors in Czech are Shanghai Maling – a meat processing company (canned pork luncheon meat and ham products), which established its plant in Hrobice. There are also present in Czech Chinese world-wide known IT companies - Huawei and ZTE. The another Chinese investor in China is Yuncheng Plate Factory in Pečky, which produces gravure rollers for flexible packaging (beverage, food, flavor and so on) and gravure rollers for packaging in tobacco and decor industries (for example: tiles, wallpapers, wooden slats and gift wraps).

There are also Czech investments in China. The main investor is Skoda Auto, which opened its factory in 2007 near Shanghai. In July this year Skoda produced its one millionth car in China (in 2012 Skoda produced more than 235 thousand cars in China). The company has already announced its plans to increase employment in China to 100 thousand people by 2018 to enhance its production capability. Other investments are PPF-Home Credit Group (Czech consumer finance provider) with about 2,5 million Chinese clients; ECM Group - a shopping center ECMall (including five-star hotel and office area), Metropolis Tower in Zhongguancun area in Beijing; TOS Kunming – a joint-venture company established by Shenji Group Kunming Machine Tool company and Czech TOS Varnsdorf. The company produces precision and large-size machine tools. Recently, in March 2013, Czech investor Škoda Electric established joint-venture with Chinese Kingway Transportation Jiangsu (China-Czech consortium SKE) and opened its production line for vehicle traction units in Suzhou (Jiangsu province) in China. The another Czech company which invested in China is TESCAN – a supplier of scientific instruments (e.g. scanning electron microscopes, detection systems, etc.) – which opened its local division in Shanghai.

In case of Slovakia, Chinese IT companies are the biggest investor in the country: Lenovo and Huawei opened their service centers in Bratislava. In 2009 Chinese Mensac – rubber and tire machinery supplier opened in Slovakian city Dubnica European Research and Technical Center[15].

V4 expectations and opportunities

In relations with China all countries are focused on economic cooperation. Main stress in put on increase of export in order to improve negative trade balance with the PRC. The second goal is to attract Chinese investments as a way to exploit Chinese FDI activities in the world that would stimulate industrial production and creation of new jobs in V4 countries. In all Visegrad countries China seems to be the priority economic partner in Asia because of its size and economic performance. Bearing in mind rising Chinese middle class and interest in outbound tourism (in 2012 about 83 million Chinese travelled abroad, spending $102 billion), V4 countries are interested in attracting Chinese tourists as an potential source of high revenue.

All V4 countries promote themselves in a similar manner through underscoring: EU membership, location in the center of Europe, very good transport facilities (e.g. Bratislava argues that its close location to Budapest and Vienna airports is a strong incentive for Chinese business, while Poland stresses that is the only V4 country with direct flight connection with Beijing, additionally operated by Boeing Dreamliner aircraft) which means that V4 could be a hub for the Chinese economic presence in Europe and a gateway to other EU and non-EU European markets. V4 countries are also attractive to China because of stable economic condition despite the global and EU crisis, predictable political situation, cheaper than in “old” EU members but well-educated labor with its high productivity. In addition, all countries also underscore long history of bilateral relations without significant contentious issues. Additionally, Budapest tries to exploit supposed Chinese and Hungarian similar origin and Chinese minority presence in Hungary.

Priority given to economic cooperation is supported by rising intensity of political dialogue as a mean to facilitate China’s interest in a particular country which may result in better economic cooperation with the PRC. Intensive political dialogue with China has been observed in almost all V4 countries in recent years. What is more, countries are trying to establish special, unique and different from each other mechanism of cooperation which might upgrade status of cooperation with China. Best examples are Hungary with its policy focused on relations with China, “Mr. China” post, consulate in Chongqing, rather big Chinese diaspora in Hungary which might be seen as an facilitator for closer economic and people-to-people Sino-Hungarian relations; and Poland with its “strategic partnership” with China, strategic dialogue mechanism, and intergovernmental committee headed and planned summits of prime ministers of every two years. Czech activities are focused on institutional presence of Czech economic and tourism offices such as Czech Invest in Shanghai, Czech Trade in Shanghai and Chengdu and Czech Tourism in Beijing.

Conclusions

After achievement of main foreign political goals, V4 countries turned to Asia, paying special attention to rising China. The first country which recognized the PRC as a priority direction for its foreign policy was Hungary, which in 2003 launched policy towards China, established special commissioner, opened bilingual primary school and launched direct Budapest-Beijing flights. Pro-Chinese approach was also visible in Slovak policy towards China, which differed significantly from the Czech policy. Slovakia focused on frequent visits to China and awarding Chinese officials and diplomats with Slovak orders and other honors[16]and avoiding situation which could provoke China to negative response. Poland-China relations even after Poland’s access to the EU were proper but not very intensive, with strong China’s negative image underscored by Polish media. This approach was changed after global crisis. Recently, Poland reinvigorated political dialogue with China, launched programs of attracting Chinese investors to Poland and supporting Polish exporters to begin business in China (e.g. PAIiIZ activities, GoChina strategy, etc.), opened direct Warsaw-Beijing flight connection, and established strategic partnership relations with China.

Looking at V4-China cooperation, its seems to be apparent that in China’s eyes the most important and significant incentives for closer cooperation with V4 countries are economic conditions, potential economic benefits and stable and predictable political situation. V4 political approaches towards China do not play a very significant role in economic cooperation, perceived in Beijing as the crucial dimension of bilateral relations. Political attitude may facilitate economic cooperation, but it plays a symbolic role, which is visible on ”rhetoric” level (e.g. names of bilateral relations or Chinese statements which criticize external intervention in China’s internal affairs). It is a clear signal that China’s policy is based on pragmatism. In other words, China’s recent growing engagement in Central and Eastern Europe, including V4, generally is a result of global economic crisis and PRC’s calculations that V4 countries (and generally CEE) are prospective economic partner because of its better economic conditions than in other part of Europe. Under the circumstances, with declining exports to traditional Chinese markets (e.g., the “old” EU members), the PRC is seeking new, stable outlet markets, and political issues are factors which play minimal role in China’s economic calculations.

[1] “Chińska Republika Ludowa. Informacja o stosunkach gospodarczych z Polską” [The People’s Republic of China. Info about economic cooperation with Poland], Ministerstwo Gospodarki [Polish Ministry of Economy], www.mg.gov.pl.

[2] Ibidem.

[3] “Czech commercial and economic relations with China”, Embassy of the Czech Republic in Beijing, 1 January 2009.

[4] T. Matura, op. cit., p. 8.

[5] N. Szikorova, „Development of Chinese-Slovak Economic Relations”, Journal of US-China Public Administration, Vol. 9, No. 12, December 2012, p. 1373.

[6] Ibidem, p. 1373-1374.

[7] All data excludes Hong Kong

[8] Eurostat, EU Direct Investments, Main Indicators, Direct Investments Abroad, [bop_fdi_main]; accessed 19 29 August 2014; “EU27 Investment Stocks…”, op.cit.

[9] Chen Xin, „Trade and Economic Cooperation between China and CEE Countries”, Working Paper Series on European Studies, Institute of European Studies, Chinese Academy of Social Science, Vol. 6, No. 2, 2012, p. 9.

[10] Chen Xin, “Zhongguo qiye zai Xiongyali” [Chinese Companies in Hungary], Eluosi Zhongya Dongou Shichang, no 3, 2010.

[11] Zhang Liang, “Zhongzi qiye zai Xiongyali qiu shuang ying” [Enterprises with Chinese capital seek mutual benefits in Hungary], People’s Daily, 12 June 2012.

[12] “Gavin Dai: Huawei to expand in Hungary”, 3 March 2013, www.autopro.hu.

[13] Due to Hungarian Malev airline bankruptcy, direct Budapest-Beijing flights were canceled in 2012. Currently, the only direct flight connection between China and V4 states are Warsaw-Beijing flight (three flights per week) operated by Polish airlines, opened in May 2012.

[14] Info about Hungarian investments in China from email’s interview with Agnes Szunomar from the Hungarian Academy of Science, 22 August 2013.

[15] N. Szikorova, op. cit., p. 1374.

[16] R. Fürst, G. Pleschova, op. cit., p. 1372.